Know your file

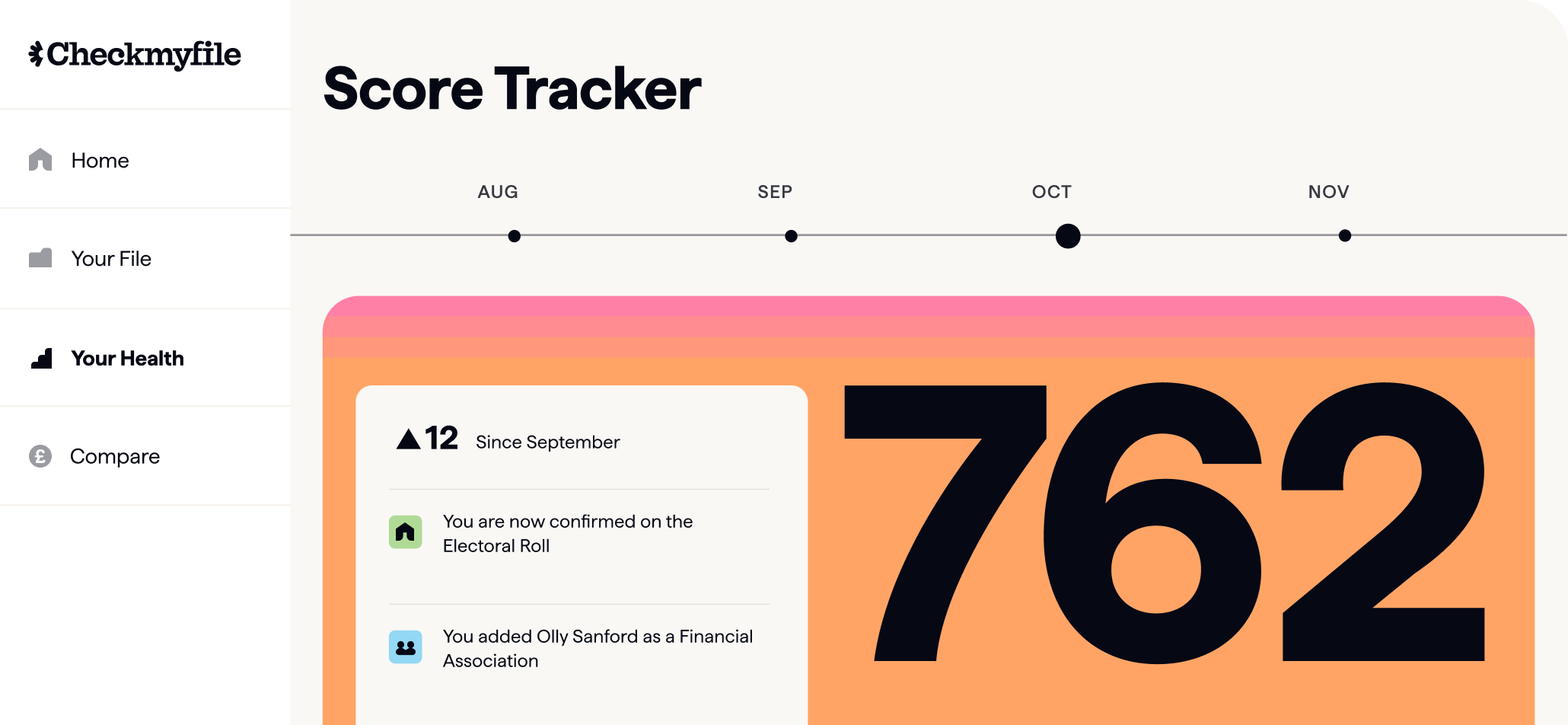

Whatever your number, whatever your goal, the first step towards growing is knowing. With Checkmyfile you get the most detailed credit report on offer. Captured in one convenient spot.

Check in with your credit health

The more you know The higher you can go

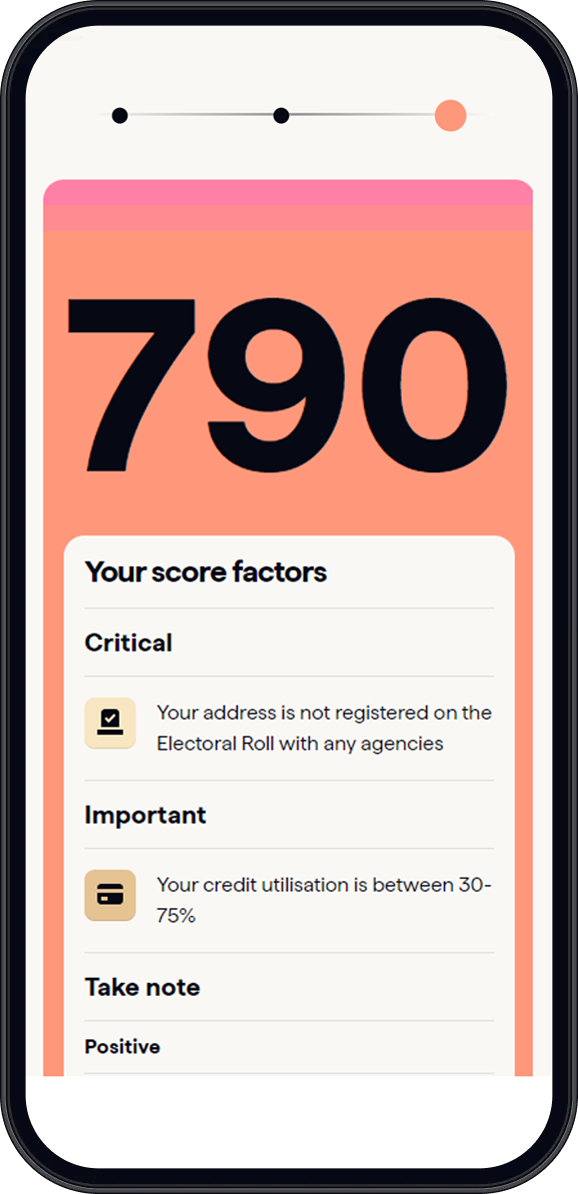

Score summary

Get a breakdown of your current score, and understand any factors affecting it.

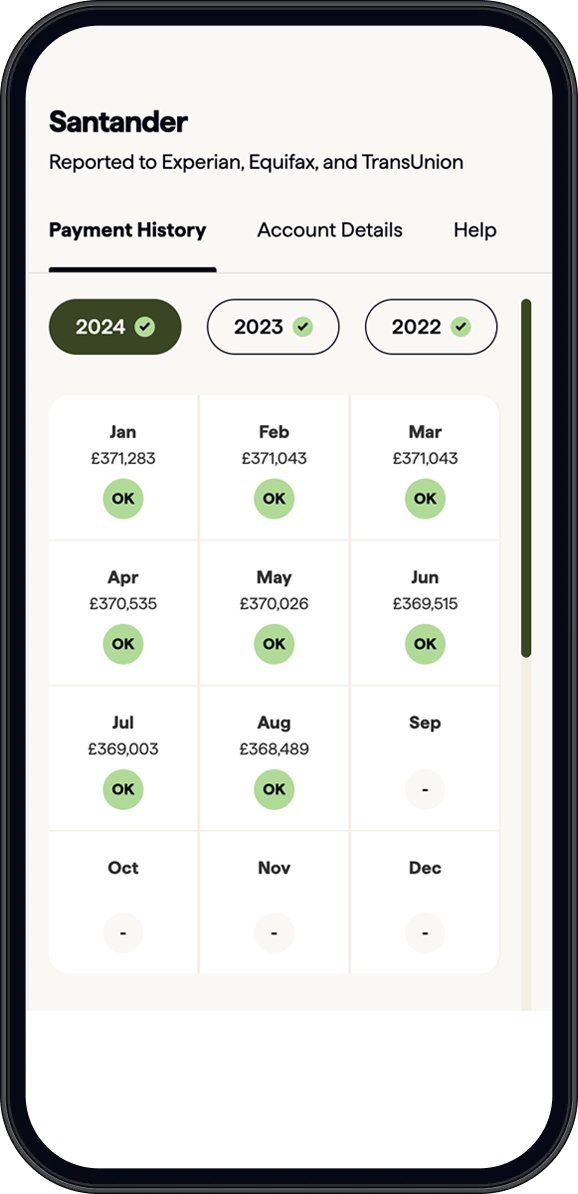

Payments & borrowing

Get a detailed overview of your payment and borrowing history over the past six years.

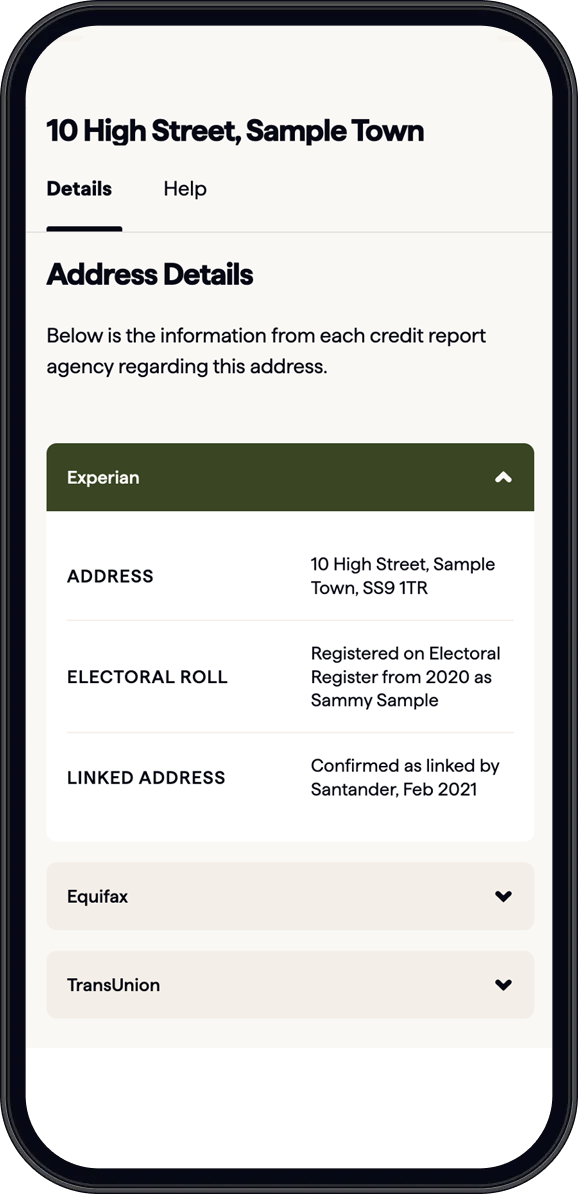

Addresses & Electoral Roll

See what information is held about your current address, past addresses and your Electoral Roll status.

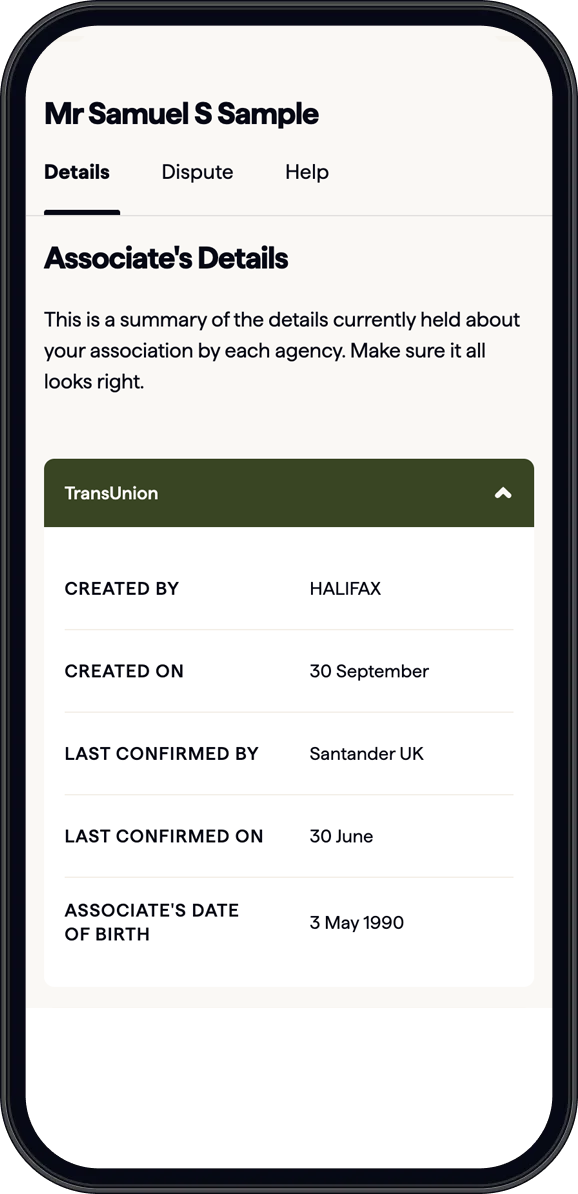

Associations & aliases

Find a full list of people you’re financially connected to.

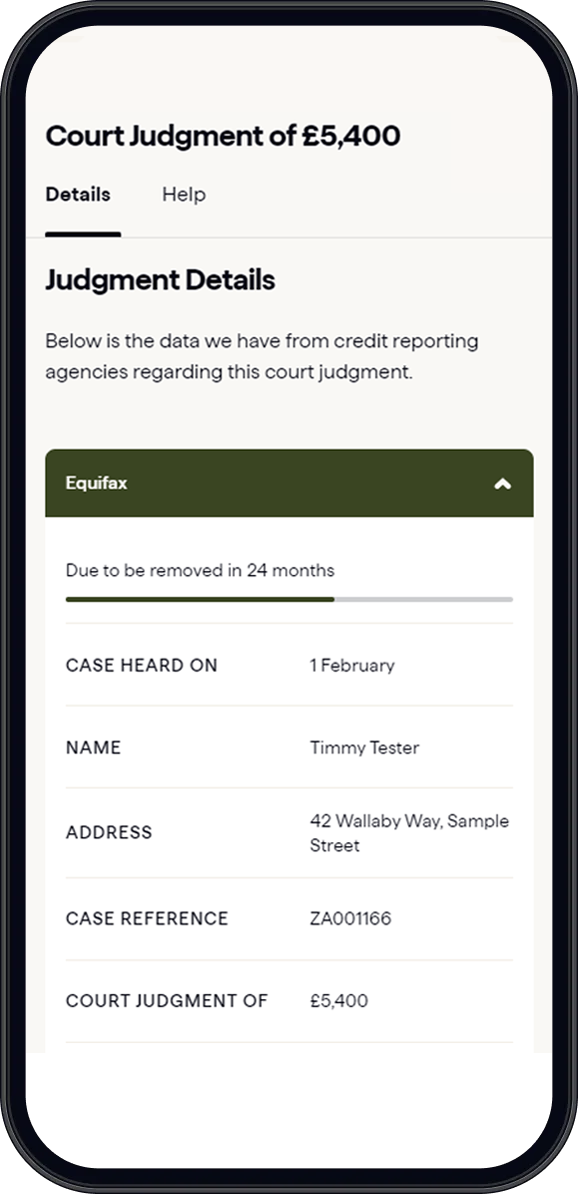

Court information

Find any court information held on your credit report with the Credit Reference Agencies.

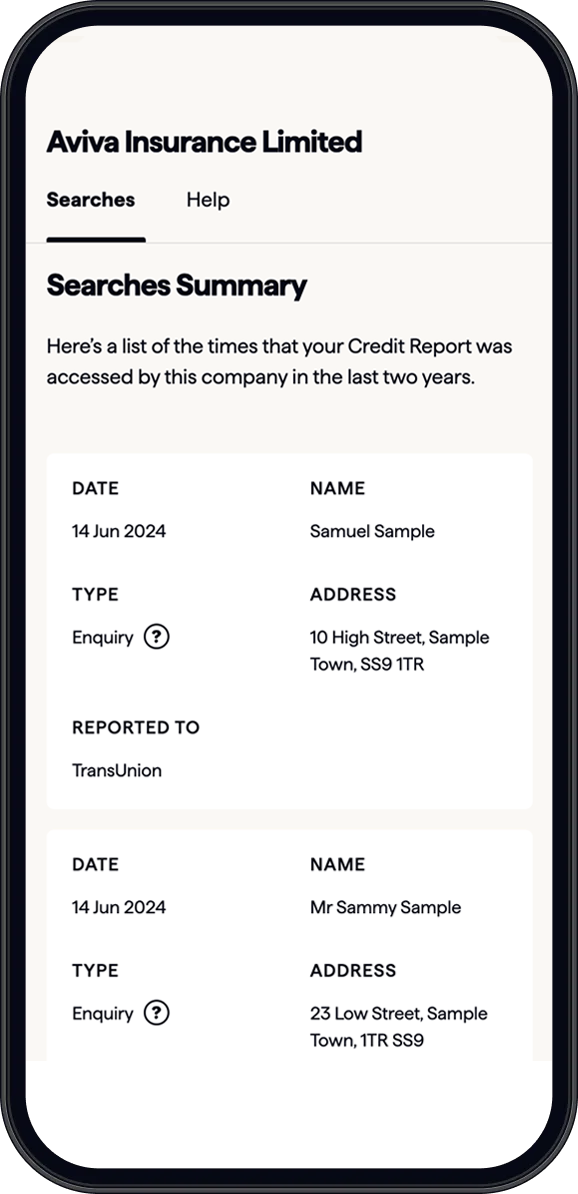

Searches

See which companies have been checking your credit report.

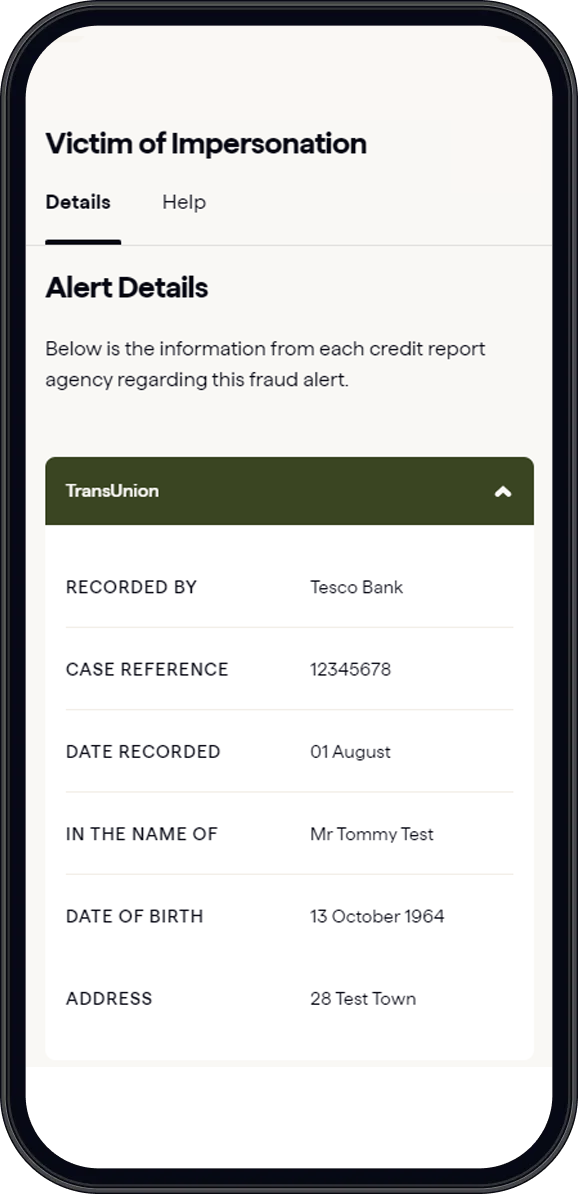

Fraud alerts

See any fraudulent activity that has been logged across your file.

Your questions have answers

Next step

Grow your score